50 December 2015 - Business View Caribbean

government services by implementing online technolo-

gies so that, for example, people can pay their taxes

or get access to governmental documents without hav-

ing to stand on long lines. He would like to “improve

our healthcare system and take full advantage of the

tremendous benefits that will be accorded to the Vir-

gin Islands under the changes that have been adopted

under the Affordable Care Act, where the government

is responsible for paying healthcare costs of those who

are either uninsured, underinsured, or who simply don’t

have the ability to pay.” In addition, he seeks changes

in the Islands’ educational system: “Understand that

more than 60 percent of our public school graduates

that are attending the University of the Virgin Islands

are on skills courses, meaning they are struggling on is-

sues of basic reading, math, and writing,” he laments.

“And when we look into the system, we see that less

than 30 percent of our third grade students are read-

ing and writing at a third grade level.”

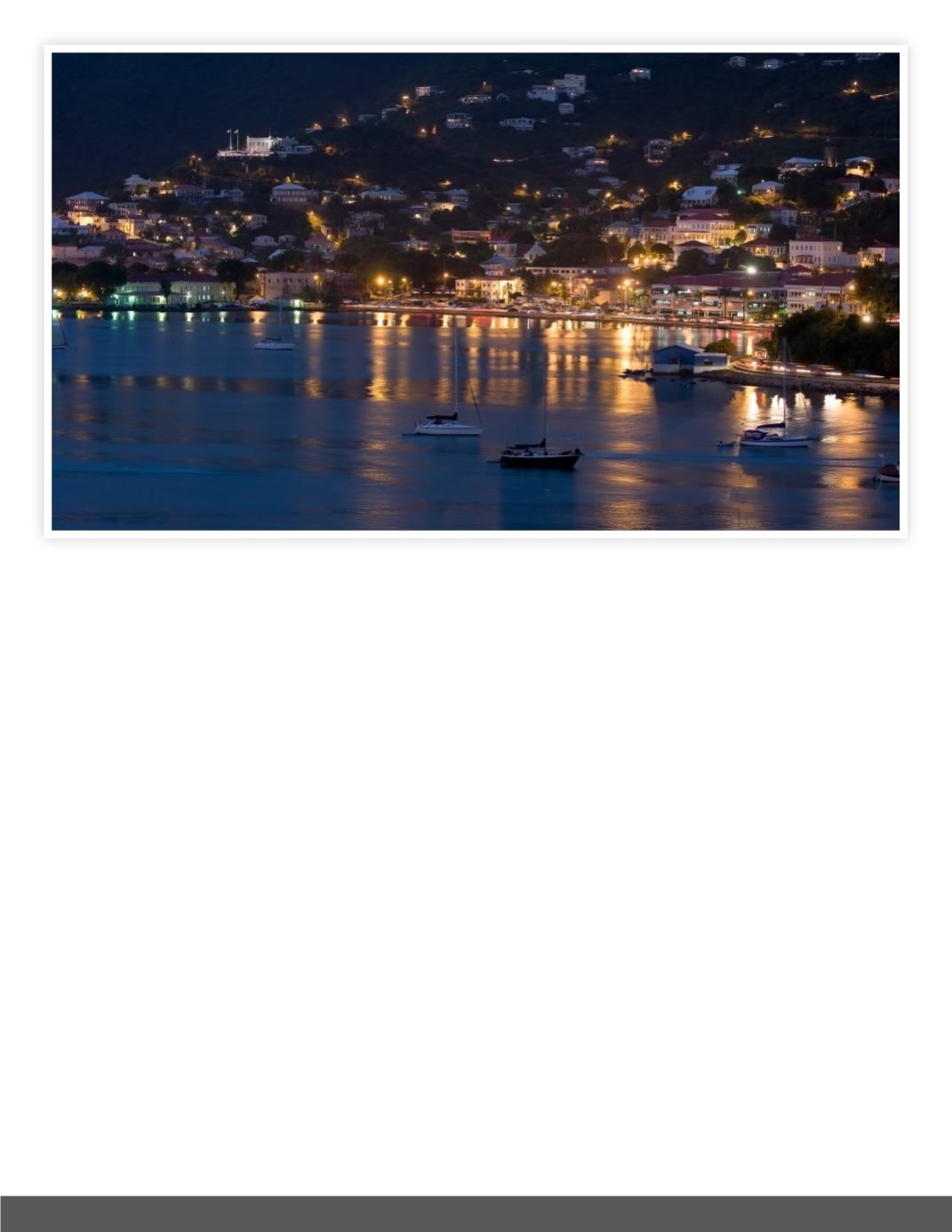

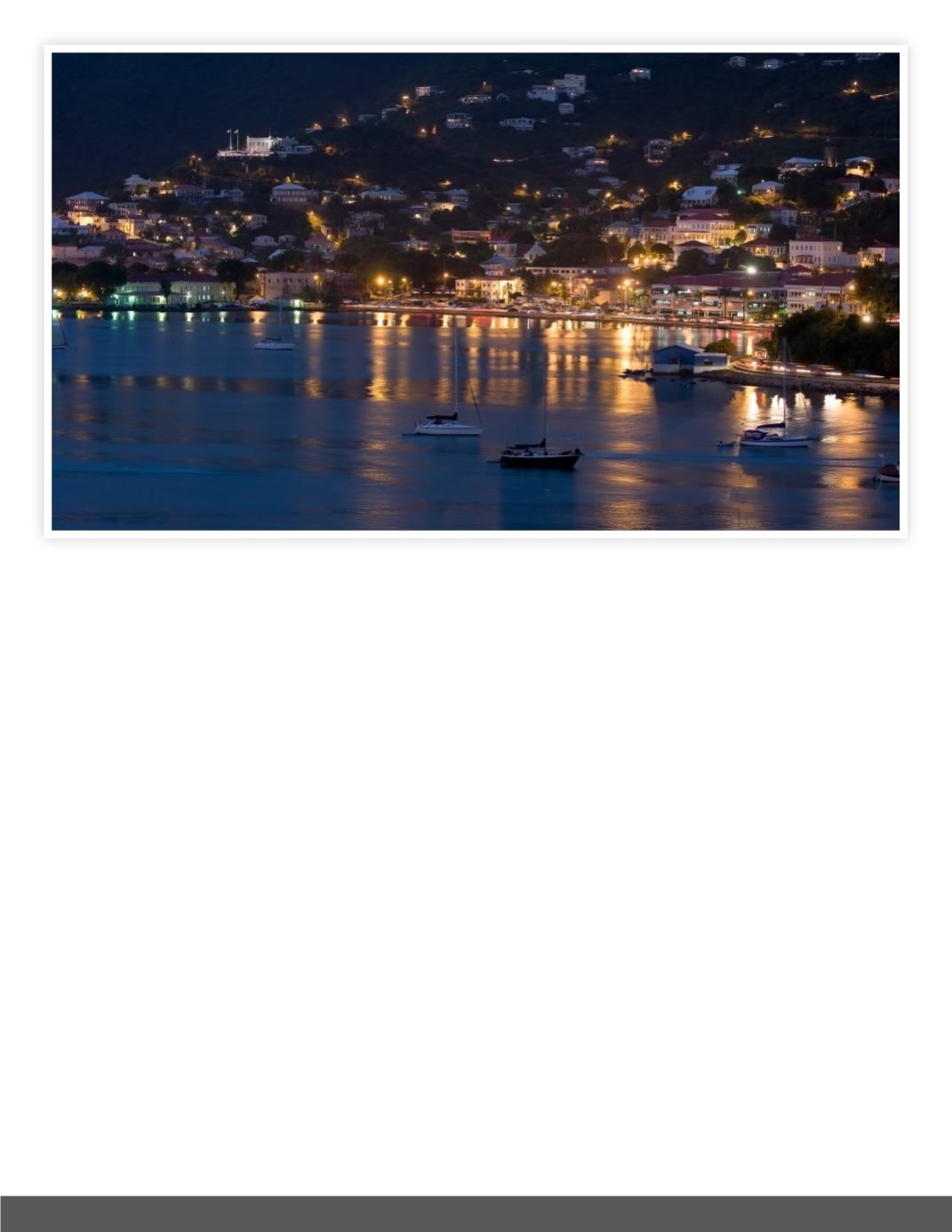

Looking to a better future for the territory, Mapp sees

the Islands’ newly upgraded technology infrastructure

as a key part of his “catch-up” agenda. He explains:

“St. Croix, for example, has the largest bandwidth ca-

pacity in the Western Hemisphere except for New York/

New Jersey, which means that St. Croix possesses

more bandwidth capacity than Silicon Valley in Califor-

nia. The Virgin Islands, to its credit, took advantage of

the connectivity program sponsored under the Obama

administration and took about $140 million in federal

and local money to do a complete fiber-optic infrastruc-

ture system connecting the three islands. Under the

connected, infrastructure system, we are on a speed

of one gigabyte per second with the capacity to go to

ten gigabytes. So, the Virgin Islands can become the

technological hub of this hemisphere.”

In addition to its high-speed connectivity, Mapp also

touts the Virgin Islands’ tax structure as a powerful

incentive that can attract a new cadre of technology-

based businesses. “By being in Ireland, Microsoft and

Apple are paying a tax rate of about 12 percent,” he