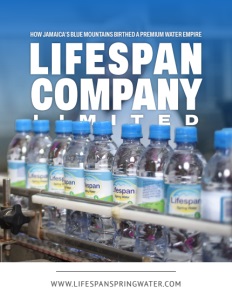

How Jamaica’s Blue Mountains Birthed a Premium Water Empire

Explore How Nayana Williams Transformed a Hidden Portland Spring into the Caribbean’s Most Certified Bottled Water Company.

In the misty foothills of Jamaica’s Blue Mountains, where ancient geological forces shaped one of the Caribbean’s most pristine watersheds, a quiet story of premium water began two decades ago. Nayana Williams discovered something extraordinary when she moved to Portland parish in 2003: a natural spring producing water with a pH between 7.9 and 8.4, naturally alkaline without any artificial enhancement.

“I wanted to also have a career and there was none that I could pursue, so I had to create something for myself,” Williams explains. “My husband at the time, his family drank from that spring, so they were quite familiar with that water and the water quality. So, we went and did the formal testing of the water and realized that it was excellent water.” The analysis revealed ideal concentrations of calcium, potassium, and magnesium, minerals essential for human health that develop naturally as rainwater percolates through the Blue Mountains’ metamorphic and igneous rocks for over a decade.

What began as necessity has evolved into Jamaica’s only NSF International-certified bottled water company. Lifespan Company Limited now celebrates its 20th anniversary in a global bottled water market projected to reach $406 billion by 2030. Williams built her operation around a spring that produces over 900 gallons per minute, though the company currently extracts only a fraction of its licensed capacity.

From Pandemic Disruption to Growth

The global bottled water industry faced unprecedented challenges during COVID-19, with supply chain disruptions affecting companies worldwide. For island nations like Jamaica, these disruptions proved particularly severe, creating cascading effects that tested even well-established businesses. Lifespan experienced the full force of these market pressures, watching costs spiral and operations strain under unprecedented circumstances.

“It did impact us in a negative way, not just being able to deliver to our customers in the beginning because that was a challenge which affected us,” Williams recalls. “But further down, we also had issues where our suppliers outside of Jamaica and inside of Jamaica had issues delivering as well. So, we came upon a situation where our shipping costs went up by 500%, like many other businesses, I’m sure.”

The crisis forced creative problem-solving when equipment parts became unavailable. Williams describes how her engineering team implemented temporary fixes that later created new problems. “Our engineering team had to come up with solutions and most of these were band aid solutions. And because of that coming out of that whole period, then you had situations like in the beginning of 2024, we had a situation with one of our major equipment going down because there were so many band aid solutions.”

Recovery proved robust once supply chains stabilized. The company not only regained lost ground but exceeded pre-pandemic performance levels by 2023, when revenues surpassed 2019 figures after declining by over 20 percent during COVID years. “We’re looking at surpassing that 2023 mark in 2025, and we’re looking at taking the company public for 2026,” Williams states, reflecting confidence in sustained growth within Jamaica’s bottled water market, which analysts forecast will reach $168 million by 2025.

Expansion Beyond Jamaica and Product Diversification

Caribbean bottled water companies increasingly look beyond their home markets as regional economies strengthen, and consumer preferences shift toward premium products. The global premium bottled water segment, growing at 7.5 percent annually, presents significant opportunities for established brands with proven quality credentials. Emerging markets across Latin America and the Caribbean show particular promise as middle-class populations expand and health consciousness rises.

Lifespan has already established distribution partnerships across several Caribbean islands and previously exported to the UK market. Williams now sets sights on the lucrative US market, starting with strategic entry points. “As a matter of fact, yes, I am thinking of building out distribution in the US starting with the state of Florida. But then of course there has been some new development with all these tariffs, which is something that we will have to continue to watch and see the feasibility of doing.”

Trade policy uncertainties haven’t dampened expansion plans elsewhere in the region. “We are also expanding into other Caribbean islands as well and other countries. That is the plan,” Williams confirms. Beyond geographic growth, the company pursues product line diversification to capture different market segments while leveraging its core brand strength.

“We’re looking at launching two other product lines, which would be complimentary to Lifespan because we have different sizes of Lifespan that target different market segments,” Williams explains. “What we’ll be doing is targeting other market segments with these new products.” This strategy follows a trend toward functional waters and specialized offerings that command premium prices. This approach mirrors successful global brands that have expanded from single products into comprehensive beverage portfolios while maintaining quality standards across all offerings.

Sustainability and Technology Integration

Environmental consciousness increasingly drives purchasing decisions in the global bottled water industry, with consumers seeking brands that prioritize sustainable packaging and ethical practices. The premium segment particularly benefits from this trend, as eco-conscious buyers willingly pay higher prices for products demonstrating environmental responsibility. Companies worldwide respond by investing in renewable energy, recycling programs, and advanced packaging solutions that balance functionality with environmental impact.

Lifespan addresses sustainability challenges through multiple initiatives, recognizing the complexity of packaging decisions. “We have recognized that every packaging material comes with its own challenges. For instance, we recognize that PET, which we use in our bottling process, is recyclable,” Williams explains. “We have recently partnered with the recycling partners of Jamaica to put up a redemption center at our head office in Portland. And this would allow persons in the community to be able to take their PET bottles to the redemption center in exchange for monetary rewards.”

Energy independence represents another sustainability focus, with solar power now providing significant operational support. “30% of our energy comes from the solar system, a PV system. And we’re looking at expanding on that as we go along. Solar would not be able to run our entire factory, but it would generate clean air energy for a huge percentage of what we consume,” Williams states.

Technology integration includes operational efficiency. The company implemented SAP Business One enterprise resource planning and incorporated artificial intelligence into administrative functions. “We use an enterprise resource system called SAP B1, which integrates all the departments and makes life a lot easier. Also, we have integrated AI into a lot of our administrative functions,” Williams notes, demonstrating how modern manufacturing combines sustainability with technological advancement.

Distribution and Leadership Evolution

Successful manufacturing companies often reach inflection points where traditional distribution partnerships limit growth potential, forcing strategic decisions about vertical integration. The bottled water industry particularly challenges smaller producers who must balance distribution reach with brand control while competing against multinational beverage corporations with extensive logistics networks. Building proprietary distribution capabilities requires significant capital investment but offers greater market control and customer relationships.

Williams recognizes these dynamics as Lifespan approaches its next growth phase. “My top priority at this time is to build out our distribution because we have relied on external distributors for a long time, like the major distributors, but we find that they still cannot deliver a hundred percent of what we need,” she explains. This strategic shift represents a fundamental business model evolution that will require substantial organizational changes.

The ambitious plan involves creating separate corporate entities to optimize operations and eventual public offerings. “Within the next 24 months, we will have two companies, our distribution company and our manufacturing company, and we are planning to take both public,” Williams states, outlining a complex restructuring that positions both divisions for independent growth and investor access.

Leadership development parallels operational expansion as Williams transitions from hands-on management to strategic oversight. “When I started the company, like most entrepreneurs starting a company, you have to be doing a lot of the things yourself. And I found myself in that space where I had to wear multiple hats,” she reflects. “I am now in the space where I am focusing on empowering leaders within my organization to lead.” This evolution from micromanagement to delegation represents a critical transition, enabling the founder to focus on strategic initiatives while building sustainable organizational capabilities.

Celebrating Two Decades, Milestones and What’s Next

Successful enterprises often mark milestone anniversaries by reflecting on achievements while positioning for future growth. For companies in competitive industries like bottled water, significant anniversaries provide opportunities to strengthen brand narratives and launch new initiatives that build on established market positions.

Lifespan’s 20th anniversary celebration extends throughout 2025, marking two decades of growth from a small Portland parish operation to Jamaica’s only NSF International-certified bottled water company. The company’s journey mirrors the broader evolution of the global bottled water industry, which has grown from a niche market to a nearly $300 billion sector driven by health consciousness and water quality concerns.

“Well, we’re planning something for midyear. We’re just celebrating the 20 years for the rest of the year, but I have a second book that I plan to launch. I want to launch that in alignment with our 20-anniversary celebration,” Williams reveals. She reflects on the broader lessons from her entrepreneurial journey: “There is a lesson in every challenge, and it’s just for us to extract that lesson. There’s no challenge that cannot be overcome.” This philosophy has guided Lifespan through multiple growth phases, from initial market entry to achieving international quality certifications and surviving global supply chain disruptions.

As Lifespan approaches its planned 2026 public offering, the company is positioned to leverage Jamaica’s natural water resources and growing global demand for premium bottled water. The Blue Mountains continue flowing, and Williams continues building.

At a Glance

Who: Lifespan Company Limited

What: Jamaica’s only NSF International-certified bottled water company, producing naturally alkaline spring water from Blue Mountain aquifers

Where: Spring Garden, Portland Parish, Jamaica

Website: www.lifespanspringwater.com

PREFERRED VENDORS/PARTNERS

Smart Haves Distributors Limited: www.smarthavesdistro.com

Smart Haves Distributors Ltd. delivers essential, innovative products designed to improve your business and quality of life. We specialize in inventory management and tailored sourcing, supplying high-quality packaging materials and everyday disposables. With a focus on convenience, efficiency, and reliability—we’re your trusted partner in streamlining operations and elevating performance.